Plant-Based Alternative Dairy Product Innovation Abounds

Plant-based product innovation abounds and consumers’ demand for alternative dairy plant-based milk and yogurt continues to grow at a fever pitch. Plant-based milk dollar sales grew 4% in 2021 and 33% in the past three years to reach $2.6 billion. Similarly, in 2021, plant-based yogurt dollar sales grew 9%, three times the rate of conventional yogurt, to a 4.5% dollar share. With a myriad of dairy and non-dairy milk products available, consumers are experimenting.

Alternative Dairy Plant-Based Products Trending

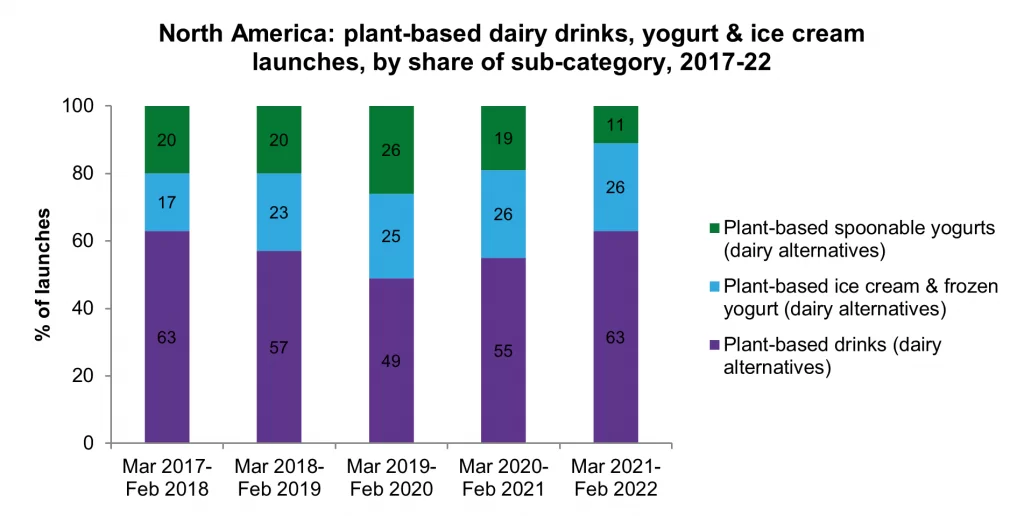

Health and environmental concerns are driving consumers’ interest in flexitarian lifestyles with a plethora of alternative dairy choices ranging from plant-based milk to yogurt to cheese. According to Mintela, plant-based innovation has been trending over the last five years in dairy drinks, yogurt, and ice cream. Of the three categories, plant-based dairy drinks are recording a faster rate of launch activity than other plant-based sectors in North America.

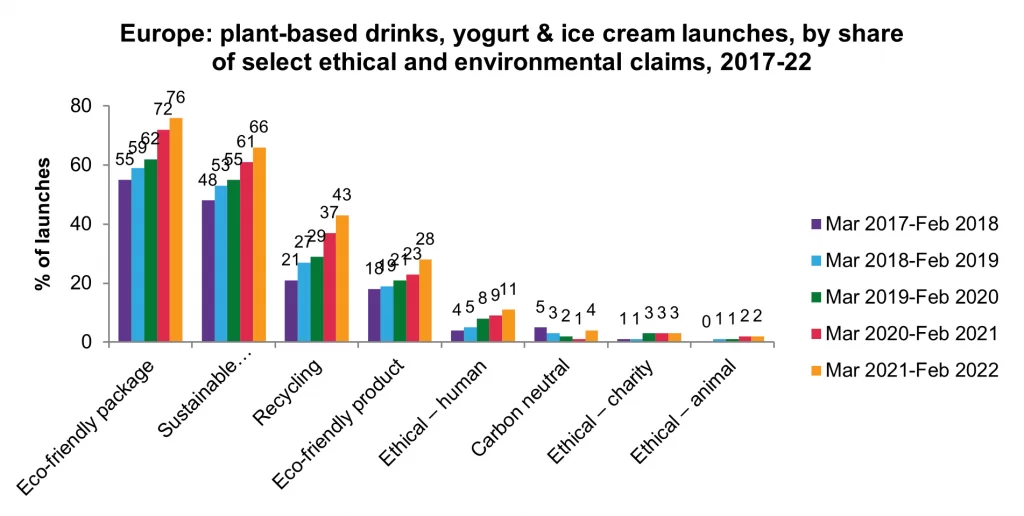

In Europe, ethical and environmentally friendly claims among plant-based drinks, yogurt, and ice cream launches are steadily increasing over recent years.

Source: Mintel GNPD, March 2017-February 2022

Plant-based product innovation abounds and consumers’ demand for alternative dairy plant-based products continues to grow at a fever pitch. Brands have the opportunity to develop new and exciting non-dairy flavors to stand out from the crowd. Contact us here to find out how Trilogy Flavors can help with your flavor development.

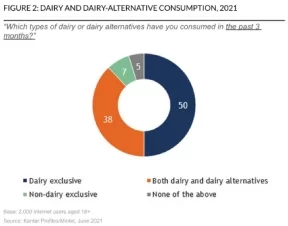

Consumer Usage of Dairy Alternatives

With a myriad of dairy and non-dairy milk products available, consumers are experimenting. According to Mintelb, over a third (38%) are dual dairy-type consumers while only 7% are non-dairy exclusive consumers.

This sentiment is echoed in a Foodnavigator-usa.comc May 19, 2022, article that states “dairy, plant-based and animal-free products often unnecessarily are pitted against each other as competing for the same place in consumers’ fridges, when in reality most Americans buy across the segment and manufacturers would be better served by highlighting how they meet shoppers’ needs rather than comparing their products to each other.”

According to Morning Consult’s researchd, two-thirds of the public have tasted a non-dairy milk while 32% of consumers use non-dairy milks at least once a week. Similarly, YouGov’s datae showed that 63% of Americans have tried an “alternative milk” (i.e., non-dairy milk, such as soy milk, almond milk or oat milk). Furthermore, according to data released by the Plant Based Foods Association (PBFA), The Good Food Institute (GFI), and SPINSf, 42% of households purchase plant-based milk, and 76% of plant-based milk buyers purchased it multiple times in 2021. Trilogy Flavors specializes in developing vegan flavors for plant-based applications. Contact us here to find out more.

Alt Milk

Plant-based milk dollar sales grew 4% in 2021 and 33% in the past three years to reach $2.6 billion. Almond milk accounts for 59% of the total category, and oat milk makes up 17% of category salesf. According to Mintela, negative perceptions of the taste of plant-based milks remain the biggest barrier to purchase among those who are not current users.

Mintel’s research showed:

- 40% of U.S. adults who do not use dairy alternatives claim the taste is the deterrent

- 67% of Polish consumers agree that dairy alternatives should resemble the taste and texture of dairy products as closely as possible

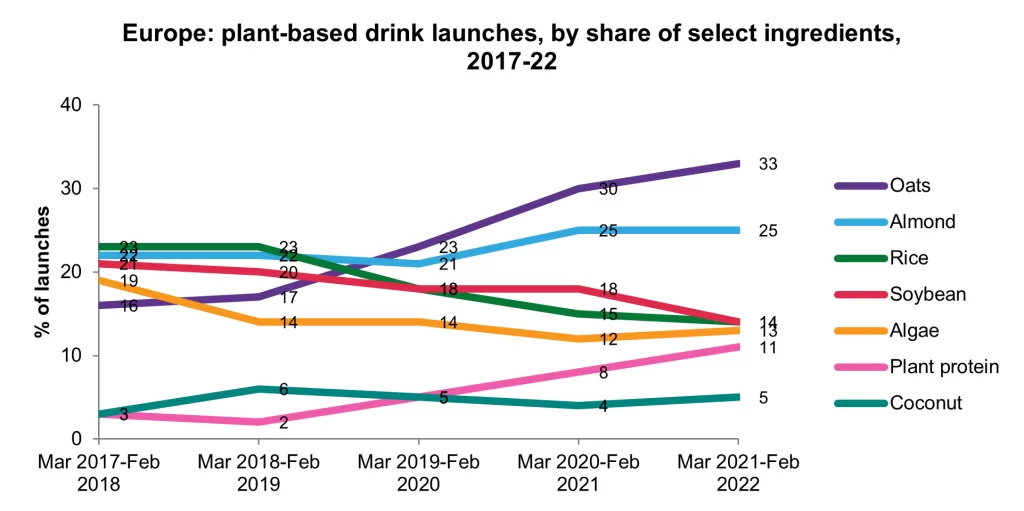

Almond milk ranks highest in associations with key attributes, such as being nutritious and good tasting. Oat milk continues to flourish because of its taste profile and reputation for being relatively planet-friendly and nutritious. 38% of U.S. dairy alternative consumers are interested in trying new kinds of dairy alternatives, according to Mintelg. To meet consumer demand, brands are exploring a variety of ingredients for plant-based milk bases. For example, in the U.S. new plant-based milk launches feature nuts such as cashew, pili and pistachio, fruits like avocado and banana, and grains like barley and hemph. A notable introduction is Molson Coors’ Golden Wing Barley Milk, a non-alcohol plant-based milk made of upcycled non-GMO barley stock, pink Himalayan salt, and shiitake mushroom. In Europe, Mintel a indicates broad beans, potato, and pea plant-based drinks are gaining traction.

Source: Mintel GNPD, March 2018-February 2022

Today, there are many plant-based beverages and creamers such as almond milk, oat milk, and coconut milk. Whether you’re looking for classic flavors like vanilla and chocolate or more novel and seasonal offerings such as caramel and pumpkin pie, Trilogy Flavors offers a variety of plant-based beverage flavors. Request your samples here.

Alt Yogurt

Like alt milk, consumers are interested in alt yogurt. In 2021, plant-based yogurt dollar sales grew 9%, three times the rate of conventional yogurt, to a 4.5% dollar sharef. Mintel’s datai showed consumers are looking for a variety of alt yogurt flavors and ingredients:

Most Common Plant-Based Yogurt Flavors from May 2017 – April 2022

- Vanilla, strawberry, and blueberry were the three most common plant-based yogurt flavors in the U.S.]

- Vanilla increased by 55%, strawberry grew 65%, and blueberry decreased by 75%

- Raspberry is a top growing flavor, up 148%

Trending Plant-Based Yogurt Ingredients from May 2017 – April 2022

- Coconut cream was the most common ingredient (37.3% of all launches) and increased by 685%

- Coconut milk increased by 148%

- Pea protein up by 106%

- Plant protein grew by 354%

- Oats have increased by 103% (from May 2019 – April 2022)

Traditionally, dairy yogurts are high in protein and consumers seek dairy alternatives with more protein. Mintel’s researchg revealed that 49% of U.S. consumers would like to see more dairy alternatives with higher protein content. Globally, only 7% of dairy alternative launches feature a high-protein claim, predominantly in yogurts and milk alternatives. In France, 68% of buyers of dairy alternatives would choose a dairy alternative product that has a high fiber content over one that doesn’t j. Trilogy Flavors has a selection of non-dairy yogurt flavors. Request your samples here.

Flavor Opportunities

Dual dairy-type consumers create opportunities for brands to design exciting products and flavors across both dairy and alternative dairy segments. As research shows, consumers expect the taste and texture of plant-based milk and yogurt to mimic that of their dairy counterparts. Consumers are not willing to sacrifice taste or flavor when choosing animal-free products. Flavor is an integral component of plant-based milk and yogurt formulas. Let our experts support your plant-based challenges and provide better tasting plant-based flavors for your alt dairy products. Reach out to us here.

Sources:

a Walji, Amrin “A year of innovation in plant-based drinks, yogurt & ice cream, 2022” May 2022, Mintel

b Bryant, Caleb “Trending Flavors and Ingredients in Dairy – US – 2021”, Mintel

d https://pro.morningconsult.com/trend-setters/alternative-milk-non-dairy-popularity

e https://docs.cdn.yougov.com/vy4b1z4v2q/econToplines.pdf

f https://www.plantbasedfoods.org/2021-plant-based-retail-sale-data-release/

g Vlietstra, Kate “Dial Up Protein Cues In Dairy Alternatives” 8, November 2021, Mintel

h https://trendincite.com/new-plant-based-milk-ingredients-and-alternatives-you-need-to-know-now/

i Mintel – Trilogy Flavors’ Custom Product Analysis

j Roux, Caroline “The Future Of Yogurt And Desserts: 2022” 20, April 2022, Mintel