Sober Curious Lifestyles Drive No/Lo Alcohol and Mocktail Exploration

As consumers seek better-for-you products, health and wellness is a key driver impacting food and beverage innovation. Alcoholic beverages are no exception. To some, going sober is about living better. More people are exploring a sober curious lifestyle. According to Mintel’s Alcohol Alternatives – US, 2022 reporta, 39% of consumers say they follow/would follow a sober curious lifestyle for physical health reasons, 29% for mental health reasons, and 71% of sober curious consumers worry about the long-term health effects of alcohol consumption. For example, “Dry January” has evolved into “Damp January.” Instead of abstaining from any alcoholic beverage, individuals are more mindful of their alcohol intake and are taking a moderate approach to alcohol consumption. Brands have noticed and are launching no/lo alcoholic beverages including Ready-To-Drink (RTD) canned cocktails, zero proof alcohol, and mocktails.

The Market

According to IWSR’s No- and Low Alcohol Strategic Studyb, which examined 10 markets including Australia, Brazil, Canada, France, Germany, Japan, South Africa, Spain, the UK, and the U.S., the market value in 2022 surpassed $11 billion, up from $8 billion in 2018. Driven by health and wellness, hard seltzers have grown exponentially as consumers look for better-for-you, convenient, and low-alcohol beverages. According to IRIc, in 2022, malt-based hard seltzers were 7.4% of total beer volume and 9.5% of dollar sales in chain retail stores. Hard seltzers paved the way for RTD canned cocktails. Globally the RTD value will rise at a CAGR of +7% between 2022 and 2026, according to IWSR datad. As consumers look for alcohol alternatives, mocktails have become more sophisticated with premium ingredients and unique flavor profiles. They are now comparable to their alcoholic counterparts. According to Yelpe, searches for mocktails were up +59%. Searches for fancy non-alcoholic drinks are up 220% while mocktail bars are up 75%, according to Pinterest Predicts 2023f. Regardless of the alcoholic or non-alcoholic beverage consumers choose to consume, the demand for innovation including new products, distinctive flavor profiles, and better-for-you ingredients is here.

From our superior raw materials through the entire manufacturing process, Trilogy Flavors consistently delivers high-quality flavors for alcoholic beverages. Browse our TTB-Approved flavors for Distilled Spirits and Beer and request your samples here.

Economic Impact

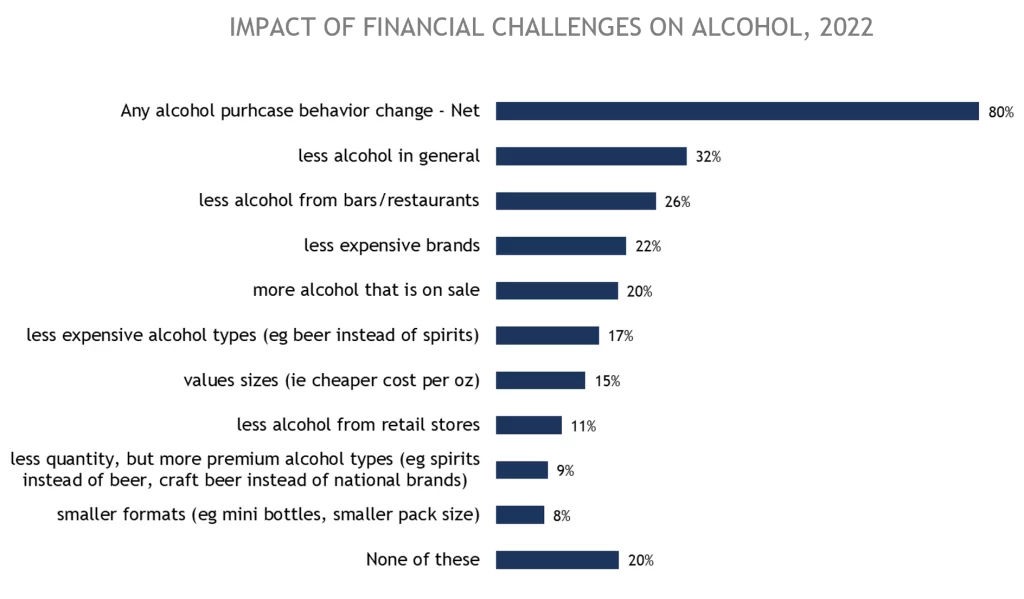

With the uncertainty of the economy and inflation, like other food and beverage segments, alcohol consumption is impacted. Consumers are changing their alcohol purchasing habits. Almost a third of consumers are purchasing less alcohol in general while more than a quarter are purchasing less alcohol from bars/restaurants. Consumers seek less expensive brands, sales, and less expensive alcohol types. According to Mintelg, among some consumers, the elevated prices will curtail experimentation with brands, new products, and even flavors.

Base: 1,495 internet users aged 22+ who have purchased alcoholic beverages from a store or for delivery (not from restaurants/bars) in the past three months Source: Kantar Profiles/Mintel, July 2022

Millennials & Gen Z Drive Alcoholic Beverage Innovation

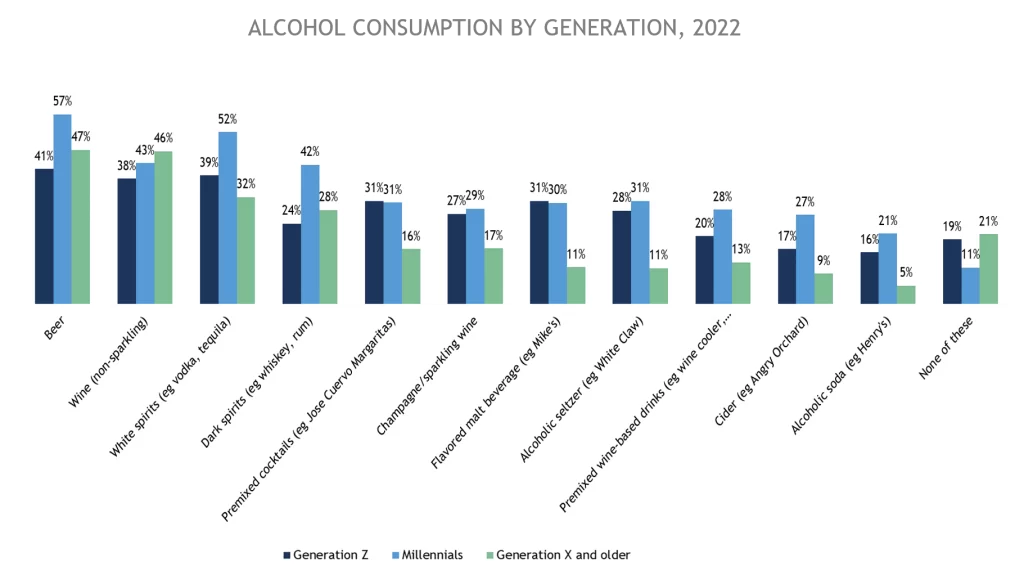

Millennials are driving alcoholic beverage exploration and are “the catalysts of the diversification within the alcoholic beverage industry.” Gen Z and Millennials are driving the adoption of RTD formats such as hard seltzers and canned cocktails. Gen Z is the demographic demanding more innovation from brands to align with their fewer yet better approach to consumption that embraces moderation, according to Mintelg. Furthermore, Mintel’s datah showed that 57% of consumers agree that low and no alcohol products “should taste indistinguishable” from the real thing.

Base: 2,000 internet users aged 22+ Source: Kantar Profiles/Mintel, September 2022

Consumer Attitudes & Behavior Towards Ingredients & Flavors

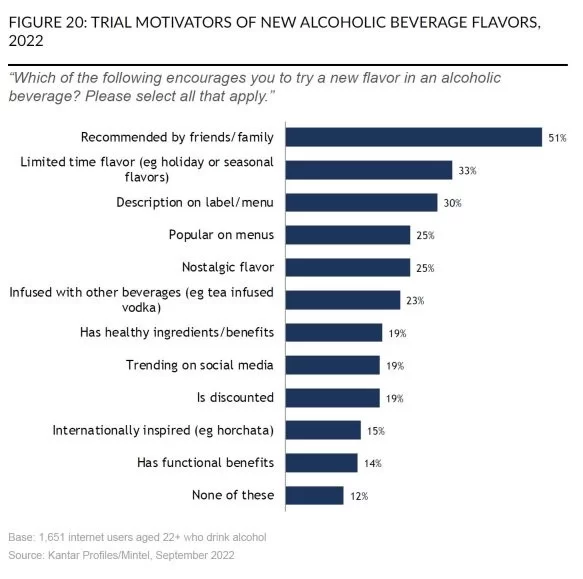

The alcohol category is a hotbed of innovation driven by ingredients and flavors. The shelves are crowded, and consumers have a lot of choices. It’s a competitive landscape with brands jockeying for position. According to Mintel’s researchg, half of consumers are encouraged to try new flavors because of recommendations from family and friends while one-third try new limited time flavors. A quarter of consumers seek nostalgic flavors and less than a quarter are interested in hybrid beverages and alcoholic drinks with healthy ingredients or benefits.

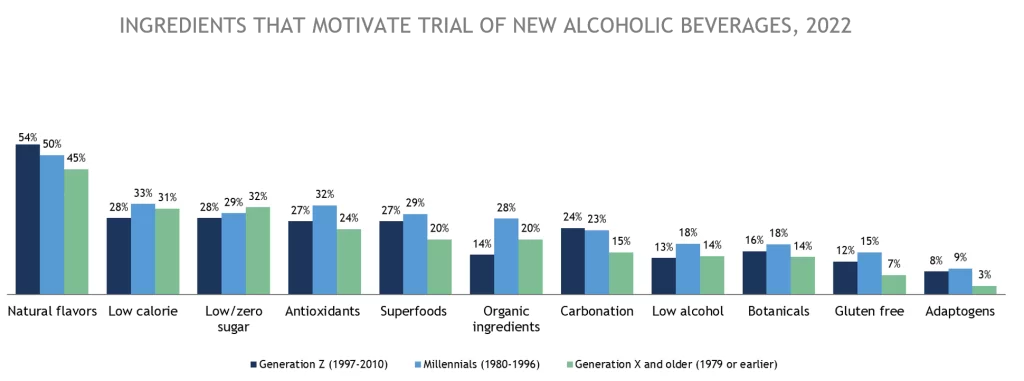

Across generations, Mintel’s datag revealed consumers expressed interest in alcoholic beverages with natural flavors, low calorie, and low/zero sugar formulas. Millennials showed interest in alcoholic beverages that feature antioxidants, superfoods, organic ingredients, and botanicals.

Base: 1,651 internet users aged 22+ who drink alcohol Source: Kantar Profiles/Mintel, July 2022

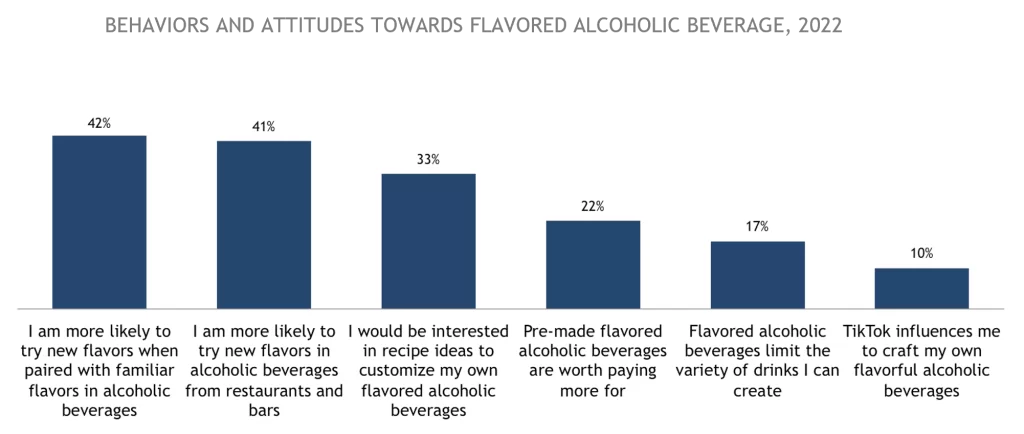

In terms of alcoholic beverage flavors, 4 in 10 people are more likely to try new flavors when paired with familiar flavors as well as try new flavors from restaurants and bars. Shy of a quarter of consumers believe pre-made flavored alcoholic beverages are worth paying more for.

Whether your customers are sober curious, looking for better-for-you options, or prefer to avoid alcohol, Trilogy offers a wide selection of beverage flavors. See our top botanical flavors here. Request your samples here.

Ready-To-Drink Alcoholic Beverages

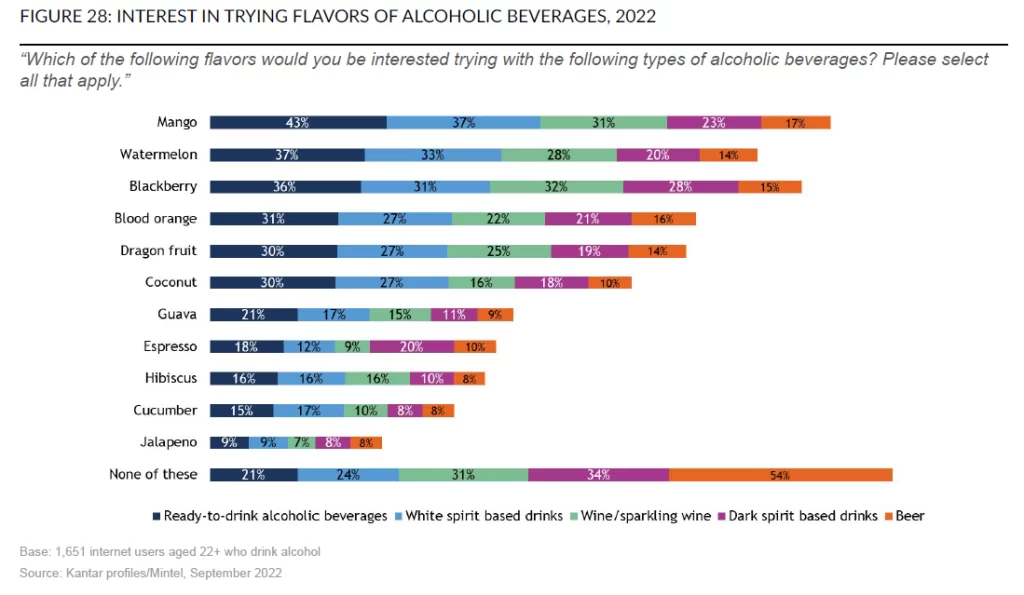

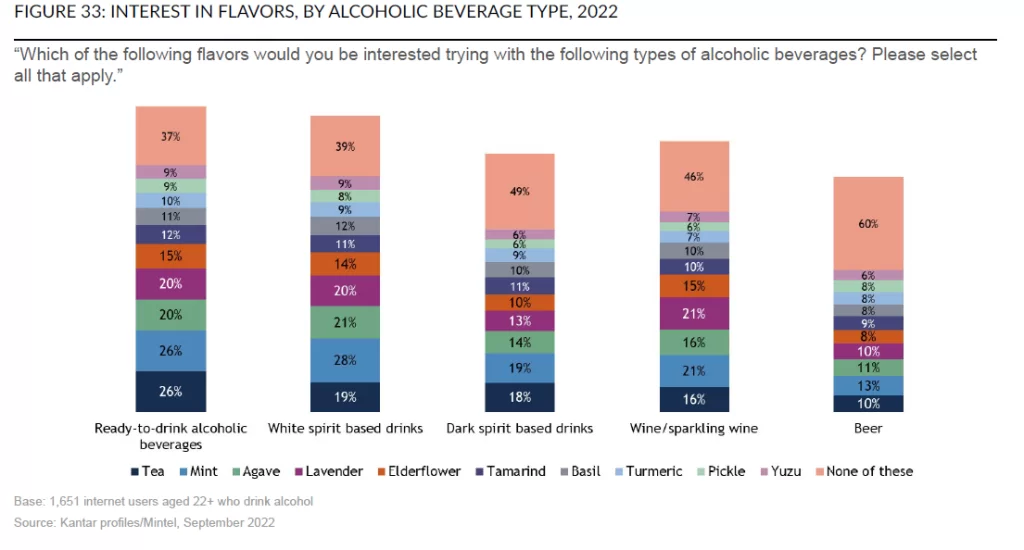

Hard seltzers paved the way for the widespread popularity of low alcohol RTD beverages and canned cocktails among consumers, especially millennials. Consumers are moving away from flavored malt-based hard seltzers to spirit-based hard seltzers with activity in vodka-based and tequila-based drinks. Spirit-based hard seltzers and canned cocktails offer more variety, with different alcoholic bases and flavor profiles like Margarita, Cosmopolitan, and Espresso Martini. Like other food and beverage categories, fruit flavors continue to dominate alcoholic beverages. There’s a growing interest in the use of botanicals such as tea, mint, lavender, and elderflower. Consumers often equate these ingredients as healthy and therefore have a healthy halo.

Trilogy’s flavor chemists create thirst-quenching beverage flavors that range from mocktails to hard seltzers to canned cocktails. With a library of flavors and essential ingredients to satisfy the requirements of clean label, organic, non-GMO, and kosher qualifications, Trilogy is your creative partner. We offer popular flavors like Cosmopolitan, Mojito, and Margarita as well as trending flavors such as Espresso Martini and Negroni. See our top flavors for RTD alcoholic beverages here or request your samples here.

Raise A Glass to Beverage Development

As consumers continue to incorporate better-for-you beverages into their diet and live healthier lifestyles, there is an opportunity for brands to expand their beverage portfolios. Whether you are formulating for alcoholic or non-alcoholic beverages, consumers expect an array of flavors. According to the Annual Bacardi Cocktail Trends Reporti, the top five cocktail flavors are Fruity, Sweet, Savory, Spicy, and Sour. Let our experts support your beverage challenges and provide tasty, mouthwatering flavors for your alcoholic and non-alcoholic products. Reach out to us here.

Sources:

a https://store.mintel.com/report/us-alcohol-alternatives-market-report

d https://www.theiwsr.com/the-8-drivers-of-change-for-beverage-alcohol-in-2023-and-beyond/

e https://www.yelp.com/article/yelps-2023-food-trends

f https://business.pinterest.com/pinterest-predicts/2023/free-spirits/

g Mintel Trending Flavors and Ingredients In Alcoholic Beverages US, 2022 report

h https://www.bevindustry.com/articles/95507-low-and-no-alcohol-beverages-gaining-popularity