THE EVOLVING PLANT-BASED CONSUMER

Trilogy Flavors has been exploring evolving consumer attitudes and behaviors towards plant-based food and beverages since 2022, when we identified Flexitarianism as a main driver of consumer usage. In 2024, the U.S. retail market for plant-based foods was worth $8.1 billion, according to SPINS1. 59% of U.S. households purchased plant-based foods, and 96% of households that bought plant-based meat and seafood also bought animal-based meat. The plant-based market is in the maturation phase and now faces the same market headwinds as the rest of the grocery segment2. With economic uncertainty, consumers are price-sensitive and budget-conscious. For example, a survey by the Physicians Committee for Responsible Medicine (PCRM) and Morning Consult3 found that more than 60% of American adults believe a plant-based diet is more expensive than one with meat and dairy. According to NielsenIQ research4, 31% say they are switching to lower-priced options, 30% are prioritizing promotions, and 29% are monitoring the overall cost of their grocery baskets.

There’s a consumer movement toward using plants themselves in plant-based products. Innova Market Insights has identified “Rethinking Plants” as its fifth trend for 2025, indicating that consumers expect plant-based foods and ingredients to stand on their own instead of being formulated as substitutes for meat or dairy. Consumers currently seek naturalness when shopping for plant-based products, and naturalness is the second most desired benefit after health5. Consumers’ current obsession is protein, and plant-based protein is riding the coattails.

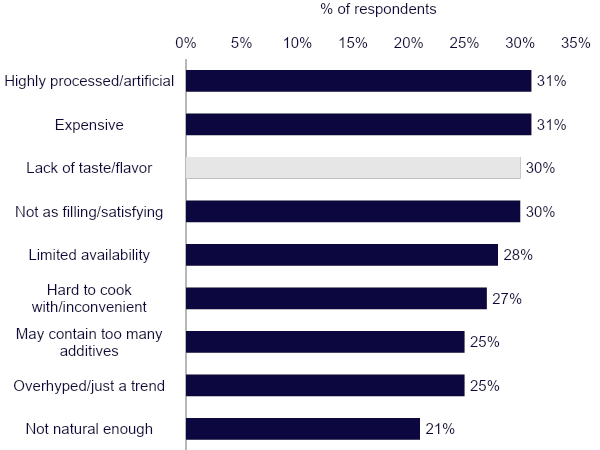

Innova’s chart6 below shows these negative characteristics that consumers associate with plant-based products. “Good taste/ flavor” is low on the list of positive attributes (21%) and near the top of the negative aspects of plant-based food.

STATE OF PLANT-BASED ALTERNATIVE DAIRY PRODUCTS

Consumers’ interest in plant-based milk, yogurt and cheese is waning as evidenced by declining sales. Circana7 reported that total sales in the plant-based milk category reached $2.4 billion, a 3% decline year-over-year for the 52 weeks ending September 7, 2025. The standout categories were coconut milk, generating nearly $126 million, a 15% year-over-year increase, and soy milk, which rose by 3% to reach $185 million. Finland brand Oddlygood Group’s survey8 of 2,000 consumers showed that as many as 62% of lapsed plant-based consumers still feel positive about the category, and 53% of consumers who have stopped drinking plant-based drinks in the past year would be likely to return. Improving taste (26%) and price (26%) were two factors that would persuade the group.

Brands continue to innovate. For example, Kate Farms introduced two High Protein Nutrition Shakes in Chocolate and Strawberry flavors. It’s the company’s first product designed to support weight management, muscle health, and users of GLP-1 treatments. The High Protein Nutrition Shakes are formulated with 25 grams of plant-based protein, 6 grams of fiber, and 27 essential vitamins and minerals. Maïzly is a new player in the plant-based market that claims to be the world’s first plant-based milk made from non-GMO corn. It is offered in Maïzly Original and Maïzly Chocolate, which contains cocoa. The products are free of dairy, gluten, nuts, seed oils, and major allergens. Benexia launched Seeds of Wellness Chia Milk, a new plant-based milk alternative. Kraft Heinz released its first plant-based dessert, JELL-O Oat Milk Chocolate Pudding, which is lactose-free, vegan, and made with oat milk.

Dairy alternative cheese accounted for $91.4 million, down 6.7%9. 37% of consumers in the U.S. and Canada prefer a natural and authentic taste in plant-based cheese, per Innova10. RIND by Dina & Joshua introduced Bleu Crumbles. The plant-based, dairy-free, gluten-free, cholesterol-free, and allergen-free product is formulated with parsnip puree, mung bean protein, and chickpea protein powder. In honor of Netflix’s Stranger Things final season five, Bel UK and Stranger Things teamed up on the launch of Babybel Hellfire, a spicy plant-based version of its Babybel snack cheeses.

There are a plethora of plant-based dairy beverages and cheeses available on the market. Trilogy Flavors offers a variety of plant-based beverage flavors and plant-based cheese flavors to meet the consumers evolving needs. Request your samples here.

PLANT-BASED ALT MEAT AND POULTRY UPDATE

U.S. retail sales of plant-based meat fell 7.5% to $1.13 billion in the year to April 20, 2025, according to SPINS11. Frozen meat alternatives accounted for $782.3 million, down 5.3% and refrigerated meat alternatives reached $439.7 million, a 12.1% decrease. Innova’s data12 found that about 20% of U.S. and Canadian consumers report eating meat substitutes. More than a quarter of meat alternative buyers ate more meat substitutes compared to the previous year. A continual challenge for consumers of alternative meat products is the taste and texture, as addressed in our previous A Flavor Chemist’s Perspective – Plant-Based Challenges and Opportunities post. Corbin’s research13 indicates that taste remains one of the top three purchasing drivers, and taste dissatisfaction and sensory challenges, like texture or flavor not meeting expectations, could contribute to declining purchase. This sentiment is echoed in Innova’s data12. When asked about desired improvements, about half of North American consumers say that meat substitutes should have better taste and texture. Additionally, consumers seek less artificial and more natural plant-based products. Artificiality is the third-most important barrier to purchasing plant-based products after price and taste, per Innova5.

Familiar and adventurous flavors are popular for both plant-based and animal protein, which may attract consumers. Products with ethnic and herb flavors are on the rise, with smoked, spices, mushroom, barbecue, and Japanese teriyaki being the most popular, according to Innova12. Interestingly, 60% of global consumers agree, or strongly agree, that plant-based alternative flavors will eventually improve14. Here are a few examples of recent activity. Impossible Foods’ latest launch is Impossible Steak Bites, made with 21 grams of protein. Beyond Meat released the Beyond Steak Filet, made from mycelium, faba protein, and avocado oil. Juicy Marbles introduced Pork-ish as a follow-up to Lamb-ish under its Meaty Meat lineup. Dr. Praeger’s introduced two frozen plant-based Grillhouse Burgers: Grillhouse Burger and Grillhouse Cheddar Burger nationwide exclusively at Whole Foods Market. The 4-oz burgers contain 20 grams of protein and are formulated with steakhouse-style seasoning and a blend of onions, carrots, sweet potato, and butternut squash. Barvecue debuted a plant-based Rotisserie Seasoned Chicken made with Barvecue’s protein blend of whole soybean and sweet potato, organic apple cider vinegar, expeller-pressed canola oil, water, and spices. The frozen shredded meat-style product is “crafted to deliver the flavor and texture of traditional rotisserie chicken, pre-seasoned and ready to heat and eat.” JUST Meat introduced three plant-based chicken products: Buffalo, Original, and Sesame Ginger. PepsiCo and NotCo collaborated on the rapid development of plant-based versions of Doritos and chicken nuggets for the Chilean market. They introduced NotMayo Doritos and NotChicken Nuggets Flamin’ Hot.

Trilogy specializes in reaction flavors with a curated line of plant-based meat flavors, many of which are oil soluble and Clean-Label compatible. Contact us today to discuss your next alternative meat project and request your samples here.

A SHIFT TO PLANT-BASED PROTEIN

Consumers’ interest in protein is fueling growth in plant-based protein. According to Innova15, globally, plant-based trends show that 42% of consumers now say protein is the most important ingredient. Furthermore, plant-based protein ingredients are demonstrating impressive growth, with a 7% CAGR. The U.S. plant-based protein market was valued at over $1.170 billion in 2025. Health, taste, and convenience are the main factors driving consumer purchases of plant-based proteins, with 70% of adults buying them, but only 12% replacing animal proteins more than half the time, according to Mintel16. In 2024, SPINS data17 showed plant-based protein powders and liquids reached $450 million in U.S. retail sales, an 11% increase versus last year. Plant-based snacks and beverages that feature protein continue to interest consumers. For example, Premier Protein added Almondmilk Non-Dairy Protein Shakes to its portfolio. It is offered in three flavors: Chocolate, Coffee, and Vanilla, each with 20 grams of non-dairy protein. According to Persistence Market Research18, the global plant-based snacks market is expected to be valued at $21.2 billion in 2025 and projected to reach $38.9 billion by 2032, with an 8.7% CAGR.

Innova19 identified “Authentic Plant-based” as its fourth trend of 2026. The trend is described as “Consumers embracing natural plant proteins for their added benefits, underscoring how plant-based is transitioning from imitation to nutrition.” 40% of global consumers point to “natural or minimally processed” as a key consideration when selecting plant-based protein options. Furthermore, nearly two-thirds of consumers surveyed globally say that plant-based products should be able to stand alone rather than substitute for other foods.

Trilogy has the technical expertise to develop delicious flavors for a wide range of plant-based proteins, catering to the ever-changing consumers’ needs. Grow your plant-based portfolio with us. Contact us today and request your samples here.

PLANT-BASED OUTLOOK

Consumers have incorporated plant-based products into their diets and lifestyles. Plant-based products have an established global presence and are now vying for consumers’ attention, competing with overcrowded shelves. According to the Good Food Institute (GFI)20, between 2019 to 2021, the U.S. plant-based retail market expanded rapidly, sales moderated in 2022 and declined in 2023 and 2024. Due to rising inflation and increased prices for plant-based products, consumers are facing tighter budgets, leading to decreased engagement in plant-based categories. As technology advances and our economy recovers, consumers will continue to incorporate plant-based products into their diets. Almost three-quarters (71%) of U.S. consumers aged 18-59 say they are at least “somewhat likely” to eat plant-based meat and/or plant-based dairy in the future, per GFI21. Currently, protein is the industry’s darling, and consumers will seek plant-based proteins that suit their lifestyles. Consumers’ interest in plant-based food and beverages is evolving. Products formulated with natural plant-based sources that are minimally processed will gain momentum. Mintel22 forecasts that the plant-based market could reach $160 billion by 2030.

Whether you are formulating a plant-based dairy, snack, alt meat, or beverage, Trilogy’s flavor chemists have the technical know-how and creativity. Contact us today to collaborate on your next plant-based project.

SOURCES:

- https://gfi.org/marketresearch/

- https://foodinstitute.com/focus/plant-based-faces-headwinds-yet-pockets-of-growth-persist/

- https://www.pcrm.org/news/news-releases/majority-us-adults-misinformed-about-cost-eating-plant-based-diet#

- https://nielseniq.com/global/en/insights/report/2025/consumer-outlook-guide-to-2026/#premium-content

- https://www.innovamarketinsights.com/trends/plant-based-trends-2025/

- Innova Market Insights 360 Flavor Report Plant-Based Innovation – Global 2025

- https://digitaledition.dairyfoods.com/november-2025/soi-dairy-alternatives/

- https://www.theplantbasemag.com/news/half-of-lapsed-plant-based-consumers-have-appetite-to-return-says-new-oddlygood-report

- https://www.dairyfoods.com/articles/98642-state-of-the-dairy-industry-dairy-had-an-excellent-year

- https://www.innovamarketinsights.com/trends/cheese-and-cheese-alternatives-market-in-the-us-canada/

- https://agfundernews.com/plant-based-meat-by-numbers-grim-reading-for-the-us-retail-market-brighter-spots-in-foodservice-and-globally

- https://www.innovamarketinsights.com/trends/meat-substitutes-trends-in-the-us/

- https://www.foodingredientsfirst.com/news/corbion-survey-visual-appeal-and-price-crucial-to-consumer-acceptance-of-meat-alternatives.html

- https://www.foodingredientsfirst.com/news/plant-based-flavor-innovation-consumer-trends.html

- https://www.innovamarketinsights.com/trends/consumer-plant-based-trends/

- https://store.mintel.com/report/us-plant-based-proteins-market-report

- https://gfi.org/marketresearch/#protein-liquids-and-powders

- https://www.openpr.com/news/4268745/plant-based-snacks-market-growth-valued-at-21-2-bn-in-2025

- https://www.foodingredientsfirst.com/news/innova-2026-fb-trends.html

- https://gfi.org/marketresearch/#introduction

- https://gfi.org/resource/plant-based-meat-consumer-segmentation/

- https://www.mintel.com/insights/food-and-drink/emerging-trends-in-the-plant-based-industry/