Introduction

Veggie burgers are nothing new, so why is it that alternative meats are so popular now? Have consumer tastes changed? Not necessarily. While the percentage of those who identify as vegetarian/vegan is still quite low, the number of people who are more flexible with their diets, also known as “flexitarians” is on the rise. Are alternative meats just a rebranded version of the veggie burgers of yore? The simple answer is no. When looking at packaging for alternative meat products, there is little to no mention of vegetables. This is done so on purpose because meat alternatives have been marketed for all, regardless of eating habits.

Alternative meats are products that contain no animal products, yet mimic muscle tissue across many attributes. The explosive rise of alternative proteins is an intriguing interaction of disruption and brand management. This new wave of innovation is aiming to make products that look, smell, cook, and taste like meat for all to enjoy. Whether it be a juicy cheeseburger, pork dumpling, or canned tuna, the end goal is to one day have meat alternatives and real meat products be completely indistinguishable. At the moment, this may seem like a pipedream, but experts say this trend is here to stay.

FOR ACCESS TO MARKET DATA AND FLAVOR SOLUTIONS, PLEASE SUBSCRIBE TO OUR NEWSLETTER.

What are Meat Alternatives?

The phrase “meat alternatives” is both vague and direct. Simply put, any product that is an alternative to eating muscle tissue from an animal that has similar nutritional benefits and is reminiscent of meat, can be referred to as a meat alternative. Many consumers are only aware of the plant-based alternatives. However, there is more to the story. Below we will examine a handful of meat alternative profiles that offer promising opportunities for Consumer Packaged Goods (CPG) companies.

- Plant Protein- This is the most well-established of the group to date. Plant proteins are often derived from protein-rich seeds through dry or wet fractionation. Soy, pea, chickpea, rapeseed, and lupin are all popular starting materials.

- Insect- Crickets, mealworms, and grasshoppers are the most commonly eaten insects and are a great, ecofriendly source of protein. Some producers are milling insects for flours. However, it is currently cost prohibitive to isolate protein from these sources, but development is still in an early stage.

- Mycoprotein – This protein source is made up of a whole, unprocessed, filamentous fungal biomass, commonly known as mold. This practice has been around since the 1980’s, and is produced through fermentation. This kind of fungi contains approximately 40% protein, high amounts of fiber, limited carbohydrates, and no cholesterol.

- Cultured meat – Also referred to as “lab-grown meat,” cultured meat is something that has been worked on since 2013 when scientists introduced the first ever lab-grown burger. Cultured meat is made using tissue-culture technology to propagate animal cells in vitro. This is the process by which animal cells are regenerated using a single cell as the source. This creates muscle tissues that mimic animal tissue and has an identical protein profile.

What is driving the trend?

Motivations behind the demand for meat alternatives differ regionally. In the US, heath is the number one concern. Many believe that consuming more protein from other sources will have a positive impact on their health. Secondary motivations surround ethical, environmental, and sustainability-related concerns. In the UK and Western Europe, the order of priorities is flipped. The environment and well-being of animals is at the top of the list for Europeans who are concerned about the long-term planetary effects of eating meat. Asia, on the other hand, presents a very different situation. Asians have been eating plant-based proteins for centuries (think tofu), so the sell is very different. Understanding the nuances of regional cultures help to answer the question, “What is Driving the Trend”.

According to the World Economic Forum, “the amount of food we’re growing today will feed only half of the population by 2050.” This coincides with the prediction that the demand for meat will grow by 70% by then. The demand for meat proteins grows as more countries worldwide develop. The ability to pay for food with more nutrition is slowly shifting from being a luxury to a way of life. Needless to say, this does not apply to every country/region on a micro level.

The following 5 topics are drivers behind the rise in demand for alternative meat. An infinite amount of time could be dedicated to writing about each of these, but we will list some of them for your consideration.

- Health and Wellness

- Increased demand for protein as a macronutrient

- Animal Welfare

- Environmental Sustainability

- Climate Change

COVID-19 Related Considerations

According to Market Research firm, Mintel, producers of meat alternatives should take the following three perspectives into account due to the global pandemic.

- Expect “Less but Better” Approach to Animal Protein

The pandemic has boosted the demand for consumer staples like red meat, chicken, and eggs as more people are cooking at home. A “less but better” approach to consumption is going to shape the meat industry in the years to come due to health concerns, refined tastes, and economics. The economic recession, supply chain challenges, and a consumer shift towards prioritizing personal health and planetary preservation are all factors to take into considering when viewing the future of meat and other protein sources.

Some believe that cleaner processing techniques and climate friendly approaches to raising animals and harvesting meat, resulting in lower yields and higher prices, will lead consumers to view meat as a luxury commodity. Where does this leave producers of meat alternatives? Will they be able to capitalize on this gap in terms of consumer sentiment?

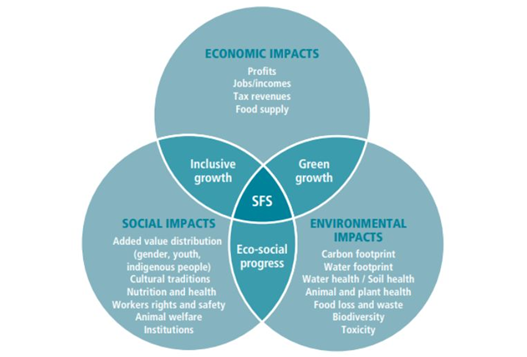

- Expand the Definition of Sustainability

Ethical and environmental motivations for eating healthier and sustainable products will continue to place pressure on meat companies to ramp up their sustainability commitments. The focus will shift towards support people and communities, as farmer and employee welfare are in the spotlight.

Figure 1 Sustainability in Food Systems (SFS)

- Double Down on Health and Value

Protein’s connection to immune health and overall wellbeing will become a key selling point for meat, which offers high-quality protein. In the US, 35% of adults who are seeking to add more plant foods into their diet say they need more protein in their diet, and 40% of Canadian meat-alternative consumers say protein content is the most important quality they look for when buying meat alternatives. Additionally, 45% of US consumers strongly or somewhat agree that plant protein is healthier than animal protein. Showcasing value will be key to maintaining share of plate for animal proteins and substitutes alike. In particular, as pressure from cultured meat intensifies when these products reach economic scale. As discussed above, cultured meat is still very early on in the development process, but is expected to hit shelves within the next decade. If cultured meat is able to be sold at a low enough price point, it could compete with other meat substitutes and “real meat.”

Quick Market Facts

- In the US, 35% of adults who are seeking to add more plant foods into their diet say they need more protein.

- The alternative meat industry could be worth $140B in the next 10 years.

- 98% of consumers who buy alternative meat, also buy real meat.

- According to a study by the United Nations, World Bank, and A.T. Kearney, by 2040, meat alternatives are expected to make up 60% of meat sales.

- Of those who ate the Impossible Whopper from Burger King, 70% said that they regularly eat meat.

Conclusion

The main barriers that are currently keeping alternative meat from going mainstream are flavor and cost. In the U.S. a quarter pound of plant-based meat costs $2 more than real meat. Although health is a top-driver for consumer behavior, alternative meats do not yet have the taste and price point needed to become a daily staple. Brands are doing their best to put alterative meat products where meat eaters shop in order to come across as an everyday item. Companies pay significant amounts of money to have their alternative meats placed in prime real estate along the meat aisle in grocery stores, and in bright and enticing pictures on fast food menus. If producers of meat alternatives continue to target meat-eaters and flexitarians, alternative meats have a strong chance of becoming the new normal across demographics.

Source: Mintel Food and Drink Platform